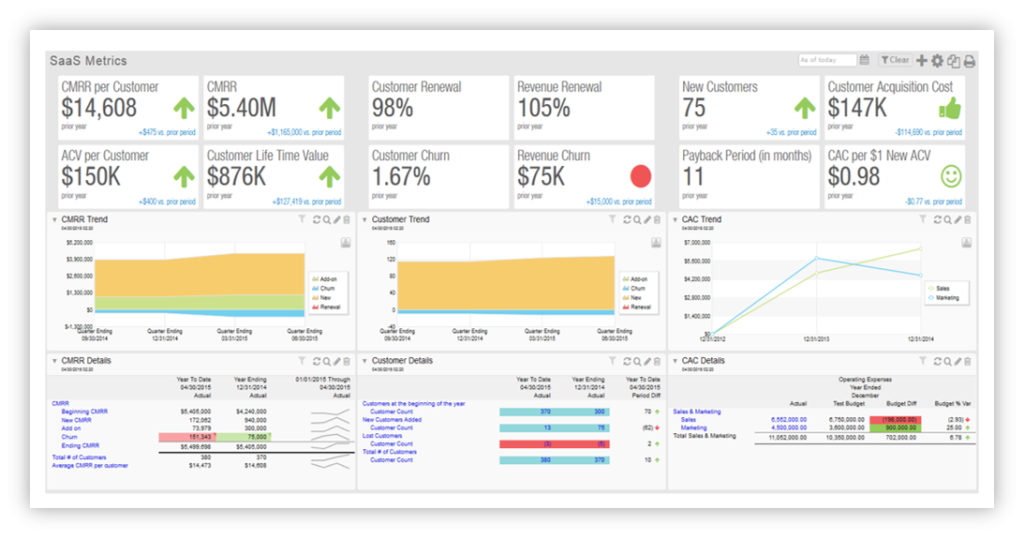

Above: Intacct Dashboard

Are you outgrowing your QuickBooks accounting software? How do you know if your firm is ready for an upgrade?

If you have a growing company with a significant amount of accounting complexity, a new cloud-based accounting system could be the right way to go. One of the more popular tools in the market today is known as Intacct (short for Internet Accounting), and if QuickBooks is feeling small to you, Intacct could be a better fit. On the other hand, Intacct is not right for every company, and it can be too much horsepower for many.

Before getting into the details, full disclosure: My company has been an Intacct Accounting Partner for several years. While it’s safe to say that I’m definitely a fan of the platform, it’s also important to point out that my primary goal is helping each of my clients use the right accounting software for them. Additionally, I’ve seen some firms struggle with Intacct because it’s been too much for them. Frankly, for many smaller companies, QuickBooks can still be a better accounting tool. With that in mind, for those considering Intacct – as well as for those who haven’t heard of it before – here are some of my thoughts on the platform, and how to determine if it might be a good accounting solution for you and your firm.

SIX SITUATIONS THAT WOULD CALL FOR UPGRADING TO INTACCT

As a starting point of discussion, if your accounting needs lack a certain level of complexity, you may still be better off with either the desktop or online version of QuickBooks. So, what is the level of complexity that might necessitate an upgrade? Here are six situations in which Intacct might be the preferred solution for your firm:

- When you have revenue management challenges, such as subscription billing, multiple products and services, or increasingly complex deferred revenue issues.

- When you want to decrease your reliance on spreadsheets for accrual-based accounting tasks, such as deferred revenue, prepaid expenses, or fixed asset accounting, Intacct has more tools and automation. It’s also worth considering Intacct if you’d like to reduce your manual accounting processes.

- When you need more sophisticated and meaningful financial reporting to manage the business. This can include dashboard and KPI (key performance indicators) reporting on operating metrics such as committed recurring revenue, cost to acquire a customer and monthly customer churn. This would also include more granular reporting on products, services, sales regions, and for new vs. existing revenue lines.

- When you have multiple entities or business units, if you are expanding internationally, or if you need to manage multiple currencies.

- When you need a system that can grow and scale with your business and need to increase automation for accounting processes, such as managing inventory.

- When you need to improve internal financial controls to reduce the risk of fraud and enhance confidence from your investors and others who rely upon your financial information.

How many of the above situations are relevant for your company? If you found that even one or two of them are issues you’re dealing with, Intacct could be worth exploring further. And if your company’s annual revenues are at least in the range of $3 million to $5 million, it may be time to take a closer look.

QUICKBOOKS IS LIKE DRIVING A CAR, INTACCT IS LIKE FLYING A PLANE

However, Intacct does involve more complexity. My analogy is this: if QuickBooks is like driving a car, then Intacct is like flying a plane. You can travel a lot further with Intacct, but is your firm ready for the additional challenges?

With a more sophisticated system such as Intacct, you may need more skilled accounting staff to handle it. There are many more intricacies to Intacct, and your staff will need solid accounting skills to handle them. Think about upgrading the skill level of your team, either by training your existing staff, adding new staff, or outsourcing the expertise.

Additionally, you will need at least a couple of finance professionals on your team who are trained on Intacct in order to reduce your dependence on just one person. If you outsource your accounting, then just one trained person internally would be sufficient, as you would be able to rely on the outsourced accounting firm to assist.

Finally, although there is a cost to upgrade to Intacct, it may not be as high as you might think. However, there is a level of time and effort involved to get it set up correctly, as the design of the system is critical to its success.

IS XERO RIGHT FOR YOUR COMPANY?

For those who are not yet ready for Intacct, but who have grown tired of the quirks and limitations of QuickBooks, a good alternative might be Xero, a fast-growing cloud accounting platform that promises a user-friendly and intuitive experience based on a clean design (its tagline is “Beautiful accounting software”).

Xero has been in business since 2006, and it now serves over 700,000 businesses in more than 100 countries. Given its emphasis on continuous improvement (it has made an astounding 1,200 product updates just in the past year), it’s reasonable to expect that you will hear more about Xero going forward.

At Laurentian, we specialize in helping technology firms solidify their business with our outsourced accounting solutions. We are focused on tech, and only on tech, and we’d be happy to have a conversation with you about whether Intacct would be a good fit for your company.