Running a business typically involves managing many different functions, including operations, R&D, accounting, marketing and sales. At Laurentian, we find that the accounting function frequently receives less attention than the others, especially in new and high-growth companies.

While accounting may sometimes seem less mission-critical than some of the other functions, putting one’s accounting on the back burner can end up being truly damaging to a company’s long-term success. A weak accounting department can lead to the firm exhibiting sub-par performance and missing valuable, strategic opportunities. Additionally, when a company lacks solid, reliable financials, that only adds to the overall uncertainty that’s inherent in running the business.

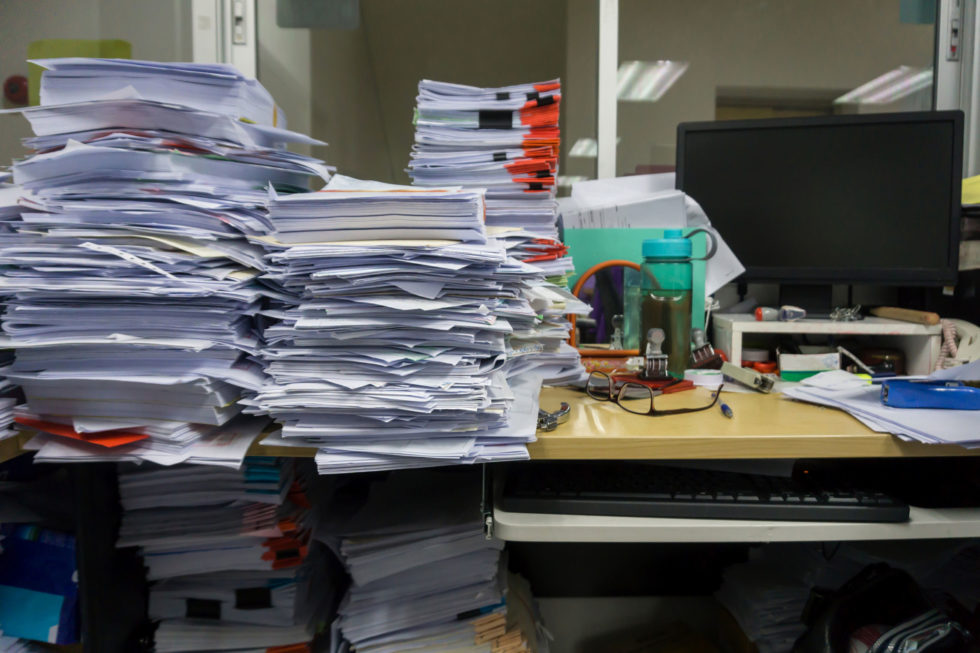

New clients have often told me that they don’t trust their numbers because the monthly reports are incomplete, or that they’re subject to constant revision, or that they arrive too late to be actionable. No matter what the cause of inaccurate, incomplete or late numbers, there are two main issues that arise from unreliable financials, and either of them can be crippling to a company’s success.

Issue #1: Uncertain Cash Flow and Muddled Planning

It’s critical for company founders and managers to understand that any missing or incomplete elements of financial management will eventually catch up to them and their companies. As we’ve all heard, if you delay addressing a problem, it will only get worse – and that’s even more true for high-growth firms.

Essentially, this means that if you don’t stay on top of your day-to-day accounting, customer invoices will go out late, which means that you’ll get paid late, which in turn can cause a cash crunch. To put it mildly, no one enjoys facing a payroll run without the required cash to fund it.

Over the years at Laurentian, we’ve met more than one tech firm founder who was entirely in the dark as to their company’s financial position. One client came to us not knowing exactly how much cash they had because their bookkeeper was submitting the monthly financial statements 6-8 weeks late.

Additionally, because the company founder was constantly moving funds among various entities, the bookkeeper couldn’t keep up with the changes. As a result of all this chaos, the founder had no idea if he could afford to hire a sales representative, which he desperately wanted to do.

One thing worth keeping in mind is that in addition to the three basic financial statements (income statement, balance sheet and cash flow statement), a cash flow forecast can be a critical tool in planning for market opportunities and resource needs, such as hiring. When planning for growth, the ability to create various possible financial scenarios is essential. Can you hire that new sales rep this year? Can you afford to invest in that big trade show? These types of decisions should not be left up to guesswork and hunches.

Issue #2: Scaring Off Outside Investors

Put simply, you cannot raise investment funds if you don’t have a clear financial picture of your company’s performance. If you’re missing the basic financial statements, simply getting a loan or equity investment will be, at the very least, delayed.

We once had to go back three years to clean up a new client’s books because they weren’t properly recognizing their subscription revenue in the correct manner for a SaaS (Software as a Service) business. It also didn’t help that the COO, who had little experience in accounting, was doing the books himself.

No surprise, but the company was unable to attract investors to get the necessary funds to grow. It took Laurentian a couple of months to clean up the books in order to catch them up. The good news is that once they were on track, not only were they able to understand their financial position, but this allowed them to tell a much-improved story to potential investors.

Most company founders would agree: Nothing is more important than fundraising opportunities and attracting potential buyers of your firm. And this means you should always be ready for the extensive due diligence that accompanies these types of deals.

Not only do you need solid financial records, but you also need to have your legal documents organized and ready to go. Are board minutes, stock grant approvals, and employee proprietary development agreements signed and easily accessible? One concern that we’ve found at more than a few clients is that a company’s cap table can be incomplete, often with missing dates or incorrect share prices.

Ultimately, if your finance department is a weak link, it will pull down your entire organization. You’ll have difficulty running the company, you’ll face greater challenges in raising funds or getting a bank loan, and it will hurt your ability to sell the firm.

Like many things, however, once you get the financials and legal documents set up, it’s much easier to keep them up to date going forward. This can significantly reduce your stress level and allow you to carefully prepare for what will be needed going forward. Moreover, once investors trust your numbers, they tend to trust you more. Just ask Noah Pittard, a VC attorney and partner at the tech-focused law firm Cooley. He writes:

Your level of organization will impress investors/buyers and they will often ratchet down their level of due diligence scrutiny accordingly because your company looks “clean” (disorganized companies tend to get labeled as having “hair” and are typically subjected to higher levels of due diligence scrutiny).

As Pittard says, if you do the right things, you can avoid a potential train wreck. Additionally, you can make your deal move faster and lower the risk of “deal fatigue.”

Concluding Thoughts

You need timely data to be able to make the right business decisions. Additionally, accurate financials are critical for you to quickly take advantage of financing options and market opportunities. Finally, you’ll rest easier knowing that your finance and accounting needs are being handled by competent professionals. These are all critical steps in helping you lay the foundation on which you’ll grow your company.

With that in mind, if it’s cleanup time for your accounting operations, consider giving Laurentian a call. No matter how messy your books may be today, we can get your accounting — and your company — back on track.