Financial Forecasting

Every tech firm we’ve ever worked with has requested a financial forecast. Why is that? In the big picture, it’s because forecasts provide executive teams with clarity and help them plan for the future. Additionally, at every step along the way, financial forecasts give firms the ability to make sound decisions and effectively manage their cash runway.

At Laurentian, we’ve used forecasts to help our tech clients obtain more than $300 million in investments.

We’ve been putting together financial forecasts for more than 25 years. Over that time, we’ve repeatedly seen that they are much more than just simply theoretical financial exercises. Instead, they help focus attention on key areas of a firm’s operations, whether it’s sales, marketing, support, or development. Additionally, forecasts help you think through your business strategy and allow you to test your assumptions.

In recent years, we’ve tested several software tools. This past year, we moved most of our forecasting to Jirav, an FP&A (financial planning and analysis) tool that was developed specifically for small and mid-sized companies (SMBs). We like the fact that Jirav gives us the ability to incorporate actual historical data to produce updated forecasts on a quarterly or even monthly basis.

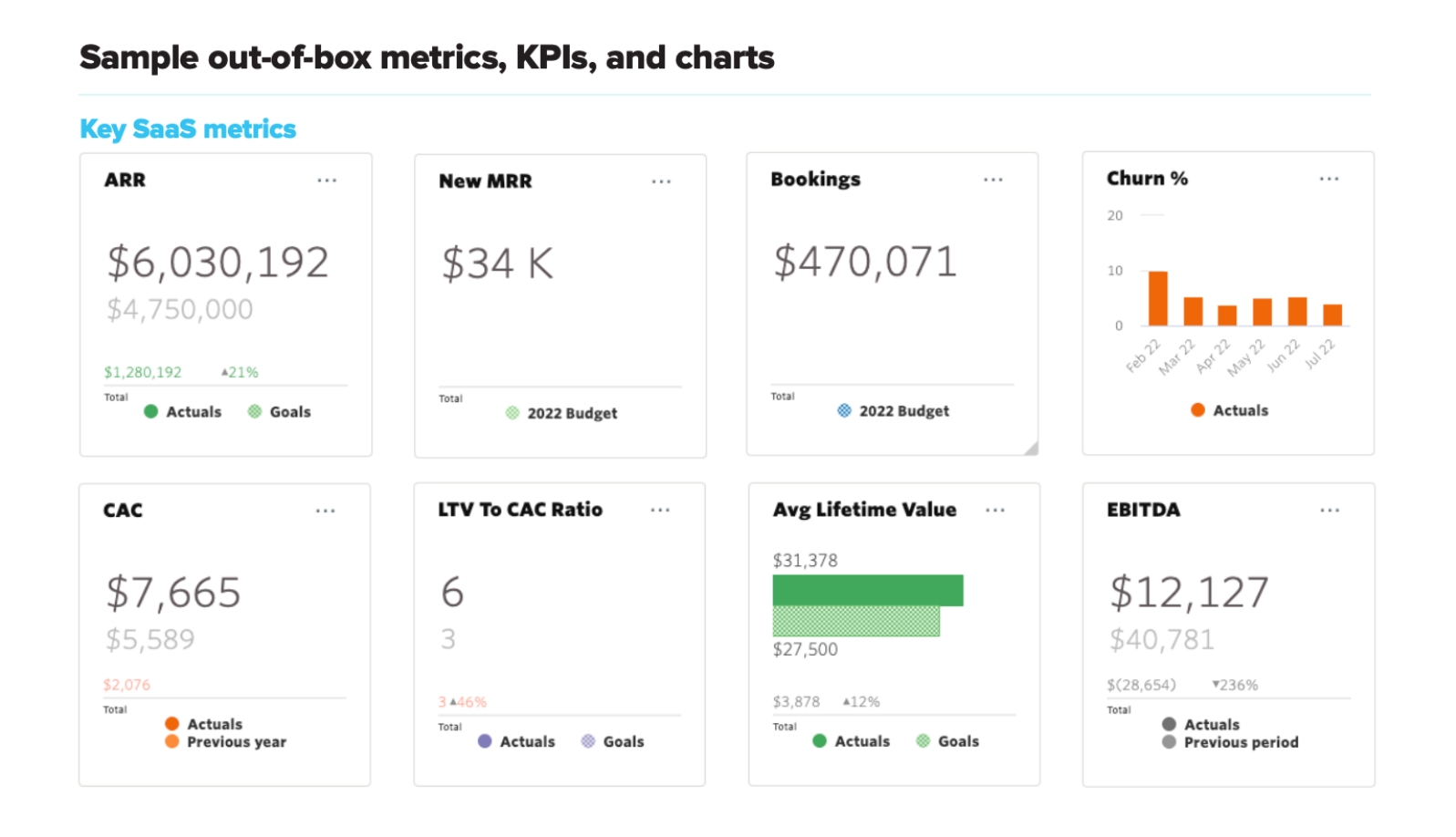

Additionally, the tool has a sophisticated dashboard with engaging visuals. Whether it’s with your team, in board meetings, or with investors, these visuals facilitate communication and can be used as single version of the truth to readily convey your firm’s financial and operational metrics.

At Laurentian, our forecasts typically include summary and detailed versions of the big three financial reports – the income statement, balance sheet and cash flow statement – with estimates going out three to five years. In addition, we often provide our clients with the base case, worst case and best-case scenario planning forecasts.

Ultimately, few companies can grow and be profitable without careful financial planning and management. At Laurentian, our method takes a whole-business approach to financial planning. We call this approach Financial Foresight, Business Focus. This holistic methodology draws inspiration from the celebrated management consultant Peter Drucker, who said, “The truth is, there’s no such thing as a ‘tax decision’ or a ‘marketing decision’ — there are only business decisions.”

Has your firm reached the stage where you’re looking for more from your accounting team than simply a focus on past results? Do you and the rest of your management team need the tools to help you be more forward thinking? If so, give us a call.

An example of Jirav’s visually rich dashboard.

Clean-up Accounting Services

Do you need some help getting your books in order? Whether it’s to get ready to apply for a bank loan or to meet with investors, we can help.

Our professionals are career accounting people who take great satisfaction and pride in managing efficient operations in order to help keep companies on track.

We can assist you and your team with the following:

- Accounts Payable

- Billing

- Accounts Receivable

- Payroll

- Credit Card Management

- Bank Reconciliations